The Supreme Court today made a decision to strike down DOMA (Defense of Marriage Act); this will dramatically expand the access of married gay couples to many federal benefits related to tax, health and pension that have been denied to them until now. This decision affects same sex couples in the 12 states and the District of Columbia which allow gay marriage; these couples represent about 18% of the U.S. population. With the addition of California, the percentage will shoot up to 30%.be even higher.

DOMA was signed into law by President Bill Clinton in 1996, and prevented the government from granting marriage benefits in more than 1,000 federal statutes to same-sex married couples in the states that allowed gay marriage.

One very important benefit of today’s Supreme Court decision is related to estate taxes. Until now, same sex married couples could not benefit from married couple estate tax laws. Now they will have the same benefits as all other married couples.

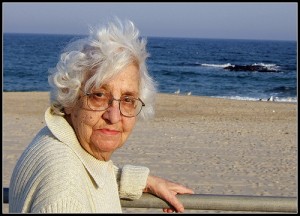

According to Yahoo News, ” Eighty-three-year-old New Yorker Edith Windsor brought the DOMA suit after she was made to pay more than $363,000 in estate taxes when her same-sex spouse died. If the federal government had recognized her marriage of more than four decades, Windsor would not have owed the sum. ”

With the Supreme Court’s decision to strike down DOMA with a 5-4 vote, Windsor will finally be eligible for a tax refund, plus interest.

For more information about estate taxes and settling an estate, go to www.diesmart.com.