- Married with no children

- The entire estate goes to the surviving spouse.

- Married with child or children

- One half of the entire estate goes to the spouse and the other half to the decedent’s descendants.

- No spouse survives but there are other relatives

- The estate will be distributed in this order of priority:1) decedent’s descendants2) parent, brother, sister or descendant of the decedent or of brother or sister

3) grandparent or descendant of a grandparent – one half of the estate to the decedent’s maternal grandparents or their descendants and the other half to the decedent’s paternal grandparents or their descendants

4) great grandparents or their descendants – one half of the estate to the decedent’s paternal side and the other half to the decedent’s maternal side

5) the nearest kin of the decedent

- Single person/ widow or widower

- The estate will be distributed in the order shown below:

- Order of estate distribution if decedent not married

- The estate will be distributed in this order of priority:1) decedent’s descendants2) parent, brother, sister or descendant of the decedent or of brother or sister

3) grandparent or descendant of a grandparent – one half of the estate to the decedent’s maternal grandparents or their descendants and the other half to the decedent’s paternal grandparents or their descendants

4) great grandparents or their descendants – one half of the estate to the decedent’s paternal side and the other half to the decedent’s maternal side

5) the nearest kin of the decedent

- No surviving relatives

- The real estate reverts to the county in which it is located; all other personal property becomes the property of the county in which the decedent was a resident or becomes the property of the state of Illinois and should be delivered to the State Treasurer.

- State link

- http://tinyurl.com/cy8cjy

Tag Archives: dying intestate

5 ideas to consider when doing estate planning

If you have a spouse and family, you’ll probably leave everything to them. However, if you don’t have a spouse or kids and you’ve been procrastinating doing your estate planning because you’re not sure what to do about all of your stuff, here are 5 ideas you should think about consider. We found them in the Rapid City Journal.

- Consider leaving something to close friends, caregivers or anyone else who you are close to.

- Think about charities that are meaningful to you. What organizations have goals that match your own?

- Think about where a donation could benefit your community. There are places like libraries, volunteer fire departments, arts organizations that would welcome some extra funds. What about giving a piece of art to a hospital or buying a park bench?

- Build relationships with people who share your interest in collections of antique, tools or other items. Then you can pass along your collections to people who will appreciate them and remember you.

- Don’t wait until you’re gone. Consider donating collections to museums or giving personal possessions that you value but don’t necessarily use to someone who would appreciate them.

For more information about estate planning, go to www.diesmart.com.

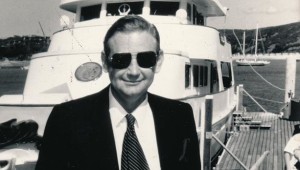

Robert Holmes a Court’s big mistake

His mistake is one people continue to make throughout the world. They don’t make a will and die intestate. About 50% of people say that they don’t have the time, don’t think they need one, don’t know how to get started, it’s too gruesome a topic to think about, they’re not going to die yet….or offer up many other excuses.

His mistake is one people continue to make throughout the world. They don’t make a will and die intestate. About 50% of people say that they don’t have the time, don’t think they need one, don’t know how to get started, it’s too gruesome a topic to think about, they’re not going to die yet….or offer up many other excuses.

Robert Holmes a Court, who had built a $2 billion empire in Australia in the 1980’s, died suddenly at age 53 without a will. Legend has it that he carried a will around in his briefcase for years…unsigned. Regardless of whether this is true or not, what is a fact is that, because he did not have a valid will, the legal wrangling to settle his estate took almost 20 years to resolve, seriously straining family relations in the process.

Two other blogs we found also discuss some of the problems that can occur if you don’t take the time to make a will.

http://www.trishparr.com/are-you-a-modern-day-scrooge/

There are two facts you can’t change:

1) You ARE going to die.

2) If you don’t have a will, the government will decide what happens to your estate.

If you have a $2 billion empire like Robert Holmes a Court, it may take you awhile to draft a will and the other documents you will need to protect your assets and ensure that they will be distributed the way you want them to be. If you have an estate that is a little smaller, a simple will can be drawn up and executed very quickly.

Don’t let the government make important decisions about your estate for you. Make the time and get your will prepared now.

For more information about dying intestate and will preparation, go to DieSmart.com.

Dying Intestate Ohio

- Married with no children

- If there are no children or lineal descendants, the entire estate goes to the spouse.

- Married with child or children

- If there is a spouse and one child or its lineal descendants surviving, the spouse get the first $60,000 if he or she is the natural or adoptive parent of the child, or the first $20,000 if he or she is not the natural or adoptive parent. In addition, the spouse gets one half of the balance of the estate. The remainder goes to the child or lineal descendants. If there is more than one child or their lineal descendants surviving, and if the spouse is the natural or adoptive parent of at least one of the children, he or she receives the first $60,000 plus one third of the balance of the estate. If the spouse is not the natural or adoptive parent of any of the children, the amount is $20,000 plus one third of the balance of the estate. In both cases, the remainder of the estate goes to the children or the lineal descendants of any deceased child.

- Order of estate distribution if no spouse survives or person is single:

- 1) children or their lineal descendants

2) parents of the deceased

3) siblings or their lineal descendants

4) grandparents

5) lineal descendants of the deceased grandparents (i.e. aunts, uncles, cousins)

6) other next of kin

7) stepchildren or their lineal descendants - No surviving relatives

- The estate goes to the state of Ohio

- State link

- http://tinyurl.com/cmduzm

Everyone needs a will. Do you have one?

It is critically important for everyone to have a will. If you don’t have one, your wishes may not be carried out. Why?

First of all, every state has laws covering what is called “dying intestate” (without a will). These rules strictly dictate who will receive what from your estate.

Let’s look at one example. You have two children. The first child worked his way through college and didn’t take any money from you. You paid all of the fees associated with the second child getting a degree and consider that money an advance on that child’s future inheritance. So you would like the first child to receive 75% of your assets and the second to get only 25%. However, when you die, you do not have a will which specifies this. According to the laws in many states, both of your children will share equally in your estate.

You may feel sentimental about some of your possessions. Maybe you have a few special pieces of jewelry and know to which member of your family you wish to give each one. Without a will, your wishes don’t count.

A will is also a good place to specify what you want your family to do with your body after you die. Perhaps you wish to be buried; however, they may not know and this and may cremate your body instead.

This week, I read two interesting blogs which reminded me of how important a subject this is. Both, interestingly enough, come from outside of the United States.

The first comes from Ghana and begins by talking about the late Colonel Momar Khadafi You may not care what Khadafi’s wishes were or that they were not carried out despite the fact that he had a will. However, later the blog talks about the writer’s father and how he set the precedent for everyone in his village to have a will.

The second was written by a woman in British Columbia and is a sad story about a man who told his former doctor, and later friend, about his wishes. However, he didn’t write them in a formal will. When he died, the doctor contacted the coroner to try to ensure that the wishes were carried out. Instead, the man’s body was turned over to the Public Guardian and Trustee (a government group) and his wishes were disregarded.

Consider getting your will written today. Not only will it make it easier for your wishes to be carried out but will remove an extra burden from your family members when you die.

For more information about this subject and other related topics check out our book “Die Smart, 11 Mistakes That Cost Your Family Money When You Die”.

F