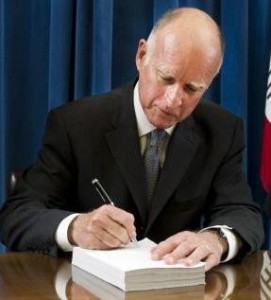

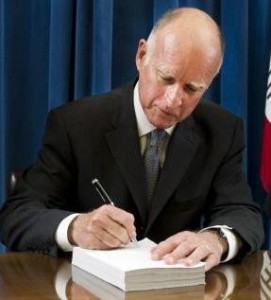

This past week, Governor Jerry Brown of California signed a bill into law that makes it legal for a dying person to end his or her life. When Brown signed the bill, he also released a letter to the state assembly explaining why he agreed to sign it.

This past week, Governor Jerry Brown of California signed a bill into law that makes it legal for a dying person to end his or her life. When Brown signed the bill, he also released a letter to the state assembly explaining why he agreed to sign it.

He said, “The crux of the matter is whether the State of California should continue to make it a crime for a dying person to end his life, no matter how great his pain or suffering. In the end, I was left to reflect on what I would want in the face of my own death.”

“I do not know what I would do if I were dying in prolonged and excruciating pain,” Brown wrote. “I am certain, however, that it would be a comfort to be able to consider the options afforded by this bill. And I wouldn’t deny that right to others.”

The law requires that patients are able to administer the life-ending drug themselves. Also, their decision must be submitted in written form, signed by two witnesses and approved by two doctors.

California becomes the fifth state to have a right-to-die law. New Mexico, Oregon, Vermont and Washington are the others.

For more information about end-of-life decisions, go to www.diesmart.com.

When cruising the web, we came across a video that very simply tells you the basics of what to do about your digital assets. Many people have what they think are comprehensive plans for their estate. However, they’ve forgotten about this very critical segment. Check out the video and then start planning….before it’s too late.

When cruising the web, we came across a video that very simply tells you the basics of what to do about your digital assets. Many people have what they think are comprehensive plans for their estate. However, they’ve forgotten about this very critical segment. Check out the video and then start planning….before it’s too late.